Navigating today’s evolving tax landscape can be challenging, especially for life sciences companies that must balance growth, innovation, and compliance. To help, we’ve prepared a Quick Tax Guide highlighting the most important provisions from the recently enacted legislation, One Big Beautiful Bill Act.

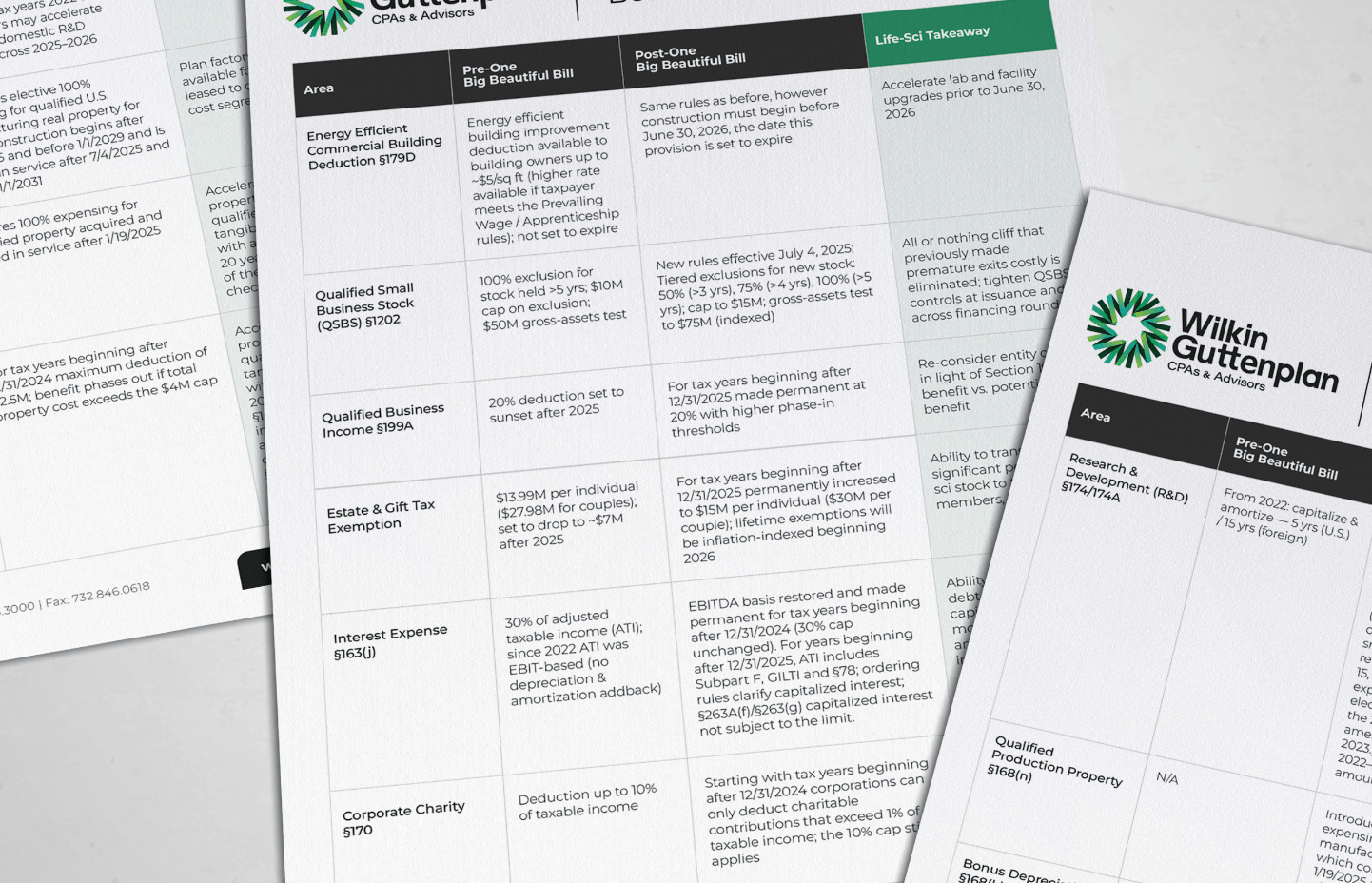

This chart provides a side-by-side look at how key tax areas have changed, what’s new for 2025 and beyond, and the practical takeaways for life sciences businesses. From R&D expensing and bonus depreciation to Qualified Small Business Stock and global tax considerations, you’ll find a clear snapshot of the rules that matter most.

Use this guide as a starting point when planning investments, financing, and operations. Then, contact your WG advisor to discuss how these changes may affect your company’s strategy.