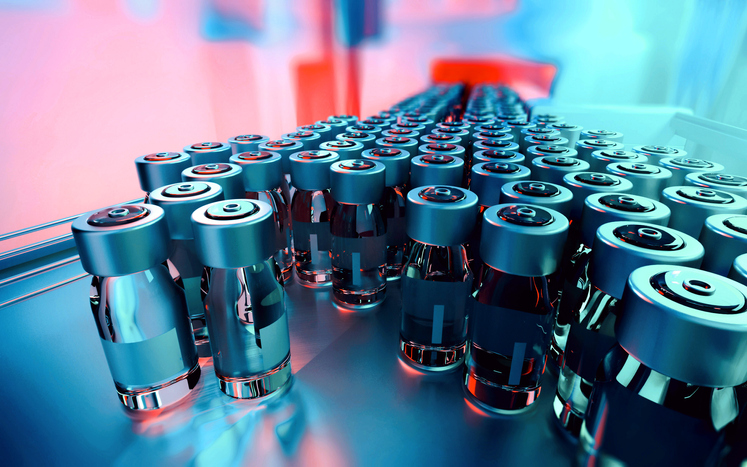

Life sciences and pharmaceutical companies face a unique set of operational and financial challenges, from conducting clinical trials to bringing products to market to expanding operations—all within a complex regulatory environment. The road to success and overcoming these challenges begins with forging strong relationships with accounting, tax, and consulting professionals with industry-specific expertise.

Our Life Sciences Practice Group serves privately-owned companies from start-ups to large multinational and middle-market companies. We have collaborated with organizations focused on many areas, including:

- Generic drug manufacturers and distributors focused on injectables, pills, and capsules

- Branded pharmaceuticals, including FDA 505(b)(2) focused organizations

- Nutraceuticals

- Organizations focused on clinical research and research and development

- Biotechnology companies