Companies in the life sciences and pharmaceutical industry often have significant amounts invested in capital assets. The tax savings related to such capital expenditures come in the form of depreciation deductions. The general rule is that the cost of capital assets is recovered over the useful life of the assets. However, the bonus depreciation rules, as discussed below, provide a beneficial exception to that general rule. Since it was first introduced, the bonus depreciation rules have undergone numerous changes. Changes in these rules can have a significant impact on the time period in which certain capital expenditures can be depreciated on a company’s tax return. Understanding the anticipated changes over the next few years to these rules will allow you to strategize the optimal time to place new fixed assets in service.

Bonus Depreciation

Bonus depreciation, also known as special depreciation allowance, is a method of accelerated depreciation that allows businesses to immediately deduct a high percentage of eligible assets during the first year it’s placed in service for tax purposes. Examples of eligible assets are those with a recovery period of 20 years or less and include, but are not limited to, computers, machinery, equipment, furniture and fixtures, and leasehold improvements.

Previous Regulations

Prior to the Tax Cuts and Jobs Act of 2017 (TCJA), businesses were allowed a first-year bonus depreciation deduction of only 50% of the purchased cost of new qualifying assets. Businesses also were allowed to deduct 50% of bonus depreciation on qualified improvement property (QIP). QIP is defined as improvements to the interior portions of nonresidential buildings if the improvements were added after the building was originally placed in service. QIP costs do not include costs related to the enlargement of a building, an elevator, an escalator, or a building’s internal structural framework.

Tax Cuts and Jobs Act

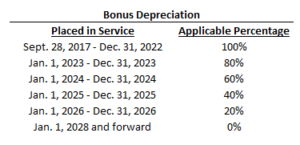

Once TCJA was passed in 2017, the bonus depreciation deduction doubled from 50% to 100% for assets that were both acquired and placed in service after September 27, 2017, but before January 1, 2023. Eligible assets acquired before September 27, 2017, remained subject to the provisions in place prior to TCJA. Under the initial TCJA statutory language, QIP was not considered to be a 15-year asset, thus, QIP was ineligible for bonus deprecation. On March 27, 2020, Congress passed the Coronavirus Aid, Relief, and Economic Security Act (CARES). The CARES Act included a corrected provision related to QIP and finally classified QIP as a 15-year property. Thus, with the passage of the CARES Act, QIP became eligible for first-year bonus depreciation of 100% retroactive for property placed in service beginning in 2018 through the end of 2022.

Future Regulations

In 2023, the 100% bonus depreciation provision that was passed with the TCJA is set to expire. Thus, beginning in 2023, businesses will only be allowed to deduct 80% of the cost of qualifying assets acquired and placed in service after December 31, 2022, but before January 1, 2024. The bonus depreciation deduction rate will continue to decline, dropping down to 60% for qualifying assets acquired and placed in service after December 31, 2023, but before January 1, 2025, 40% for qualifying assets acquired and placed in service after December 31, 2024, but before January 1, 2026, and finally only 20% for qualifying assets acquired and placed in service after December 31, 2025, but before January 1, 2027. After December 31, 2026, once the bonus depreciation provisions expire, businesses will not be allowed to deduct any bonus depreciation unless Congress provides new regulations under the income tax code.

Bonus depreciation is ultimately optional. A business is allowed to elect out of the provisions and, instead, depreciate the asset over the course of its’ assigned useful life. This may make sense in certain situations. However, in order to minimize taxable income, it’s advantageous to take the maximum amount of bonus depreciation each year.

If you have any questions about this or need advice on planning for large capital expenditures, please reach out to your WilkinGuttenplan advisor.